Several US banking groups led by the Bank Policy Institute (BPI) urged regulators to close what they say is a loophole that may indirectly allow stablecoin issuers and their affiliates to pay interest or yields on stablecoins.

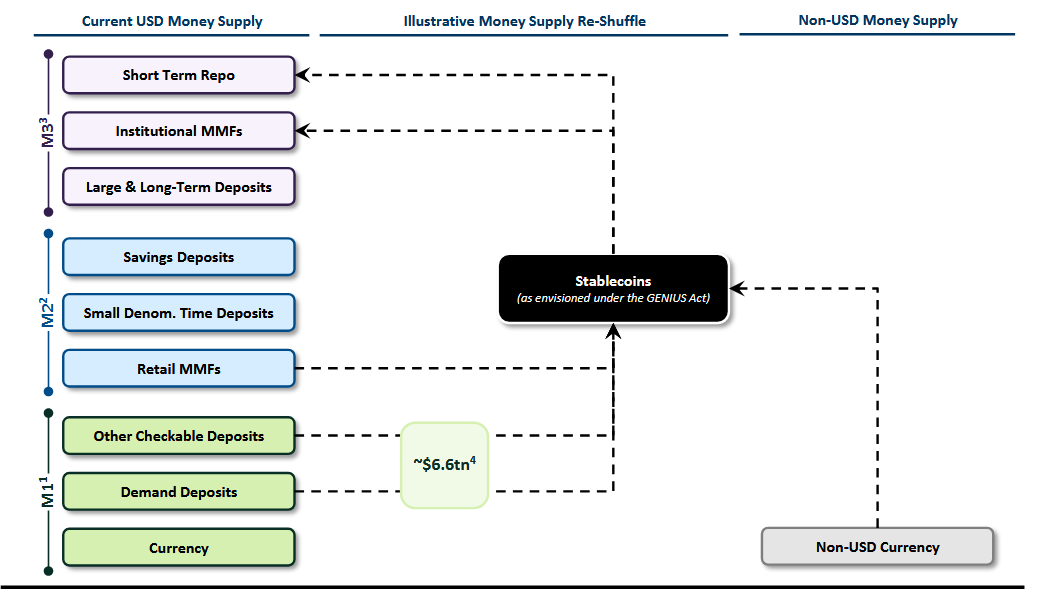

In a Tuesday letter to Congress, BPI warned that a failure to close the so-called loophole in the new stablecoin laws under the GENIUS Act may disrupt the flow of credit to American businesses and families, potentially triggering $6.6 trillion in deposit outflows from the traditional banking system.

The GENIUS Act prohibits stablecoin issuers from offering interest or yield to holders of the token; however, it does not explicitly extend the ban to crypto exchanges or affiliated businesses, potentially enabling issuers to sidestep the law by offering yields through those partners, the groups said.

Offering yield is one of the biggest marketing appeals that stablecoin issuers have to attract users. Some offer yield natively for holders while others, such as users of Circle’s USDC

USDC$0.9998, are rewarded for holding the stablecoin on exchanges such as Coinbase and Kraken.

The banking groups are seemingly concerned that the wide adoption of yield-bearing stablecoins could undermine the banking system, which relies on banks attracting deposits with high-interest savings products in order to back the loans they make.

Stablecoins could undermine credit system, bankers say

In the letter, also signed by the American Bankers Association, Consumer Bankers Association, Independent Community Bankers of America and the Financial Services Forum, BPI noted stablecoins are fundamentally different from bank deposits and money market funds because they don’t fund loans or invest in securities to offer yield.

“These distinctions are why payment stablecoins should not pay interest the way highly regulated and supervised banks do on deposits or offer yield as money market funds do.”

Allowing payments of interest or yield on stablecoins could lead to $6.6 trillion in deposit outflows, BPI noted, citing a US Treasury report from April.