Thumzup Media Corporation, a social media marketing-turned-crypto-buying firm, plans to boost its crypto holdings and get into crypto mining after raising $50 million from investors.

Thumzup said on Wednesday that it would expand its crypto-related strategy “to include large-scale cryptocurrency mining and targeted blockchain investments.”

The company said it will use some of the $50 million it raised from a $10 per share offering on Tuesday into “state-of-the-art cryptocurrency mining infrastructure” and was engaging with mining technology providers “to accelerate the buildout.”

The firm currently holds 19.1 Bitcoin after buying it for the first time in early January, joining a trend of public companies that havebought up cryptocurrenciesin the hopes of boosting their share price.

Donald Trump Jr., the son of US President Donald Trump, bought 350,000 shares of the company, then valued at nearly $3.3 million, according to a regulatory filing in early July, deepening the Trump family’s already expansive interest in the crypto industry.

Bitcoin hits new peak as it nears $125,000

Thumzup’s planned buys come just as Bitcoin has climbed to an all-time high of over $124,000, with traders hoping it will propel over $125,000.

Bitcoin hit a record peak of $124,128 just before 12:40 am UTC on Thursday, according to CoinGecko. It’s since slightly cooled to $123,683, gaining 3.6% over the past 24 hours.

Thumzup said in early July that, in addition to Bitcoin, it planned to buy up Dogecoin , Litecoin (LITE), Solana, XRP, Ether, USDC, with its board later allowing it to hold up to $250 million total worth of crypto.

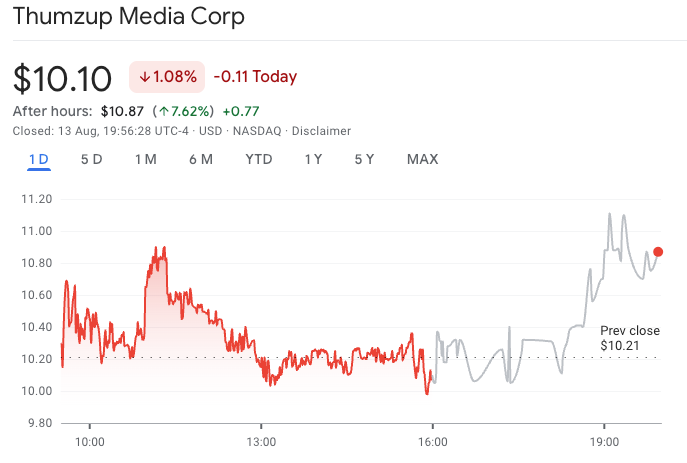

Thumzup shares lift after the bell

Shares in Thumzup (TZUP) saw a 7.62% gain in after-hours trading on Wednesday to $10.87 after closing the trading day at a loss of nearly 1.1%.

Thumzup has gained nearly 194.5% so far this year and its most recent all-time high was recorded on Aug. 8 at $15.46.

However, its stock price dropped nearly 33% to $10.40 when it opened for trading on Monday after announcing it would publicly offer non-voting convertible preferred stock, which it later changed.