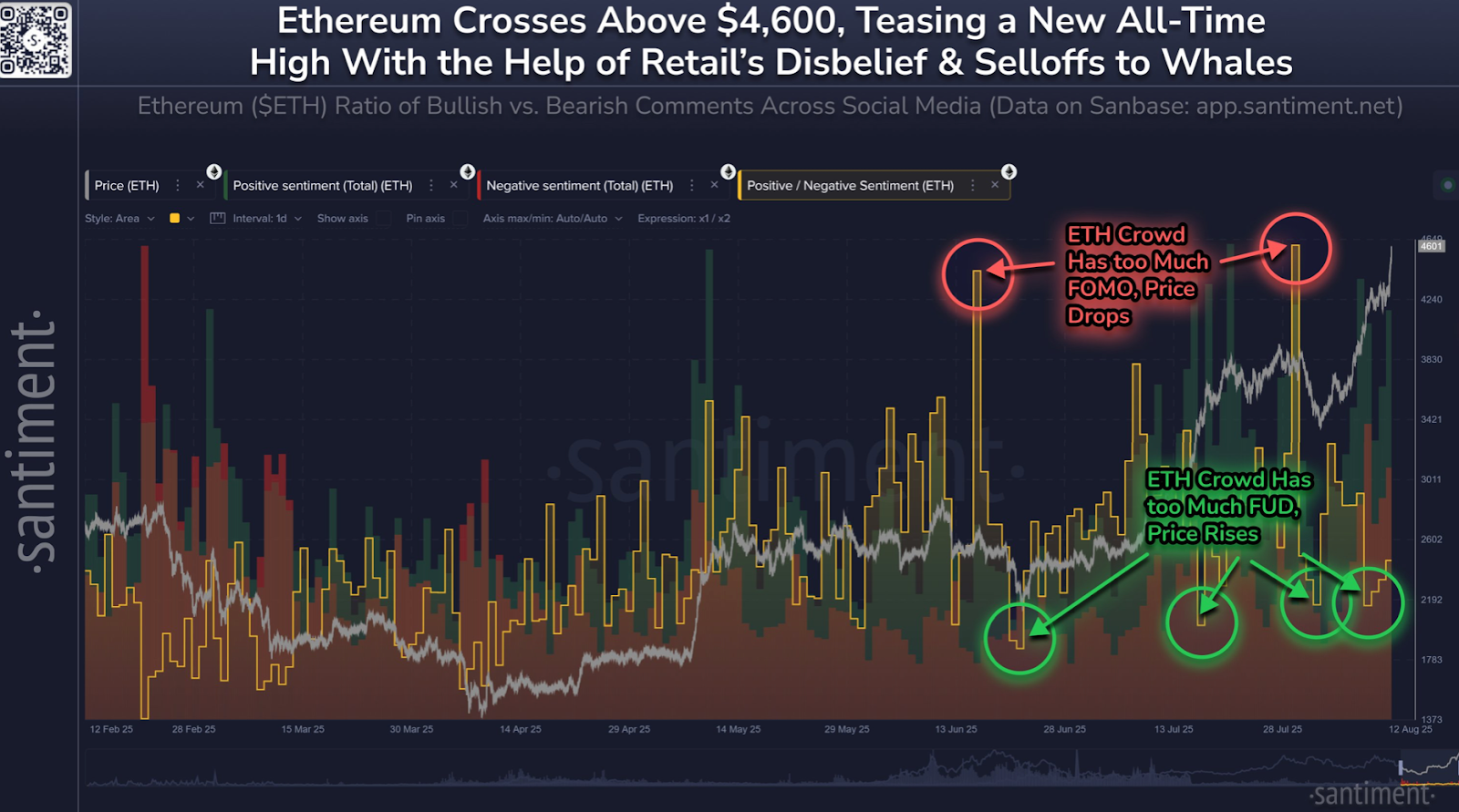

Social media chatter shows retail traders are in disbelief about Ether’s recent rally and selling off their holdings to be scooped up by big crypto buyers, said the crypto sentiment-tracking platform Santiment.

“Traders have shown FUD (fear, uncertainty and doubt) and disbelief as the asset makes higher and higher prices,” Santiment said in an X post on Tuesday, showing that bearish social media commentary on Ether

ETH$4,620outweighs bullish remarks.

Ether showing “very little sentiment resistance”

Santiment said that prices often move in the opposite direction to retail traders’ expectations. When too many traders turn overly bullish, it can signal greed in the market, which has historically been followed by sharp sell-offs.

“There was an instance of extreme greed back on June 16, 2025, and July 30, 2025, which led to price corrections,” Santiment said.

Both retracements followed a significant drawdown earlier this year. Only in April did Ether plunge 60% from its January high, falling below $2,000, according to CoinMarketCap.

Still, Santiment said smaller retail traders are showing more fear in the current rally, leading them to sell off their Ether holdings.

“With key stakeholders accumulating loose coins that small ETH traders are willing to part with right now, prices are showing very little sentiment resistance from breaking through and making history in the near future,” Santiment said.

Onchain analysis platform Glassnode said on Monday that short-term Ether holders have been selling more than long-term holders, which may mean short-term traders expect a price pullback.

Traders anticipate higher prices for Ether

Ether is about 5.53% off its all-time high of $4,878, which it hasn’t reclaimed since reaching it in November 2021. Ether was trading at $4,622 at the time of publication, up 7.95% over the past 24 hours.