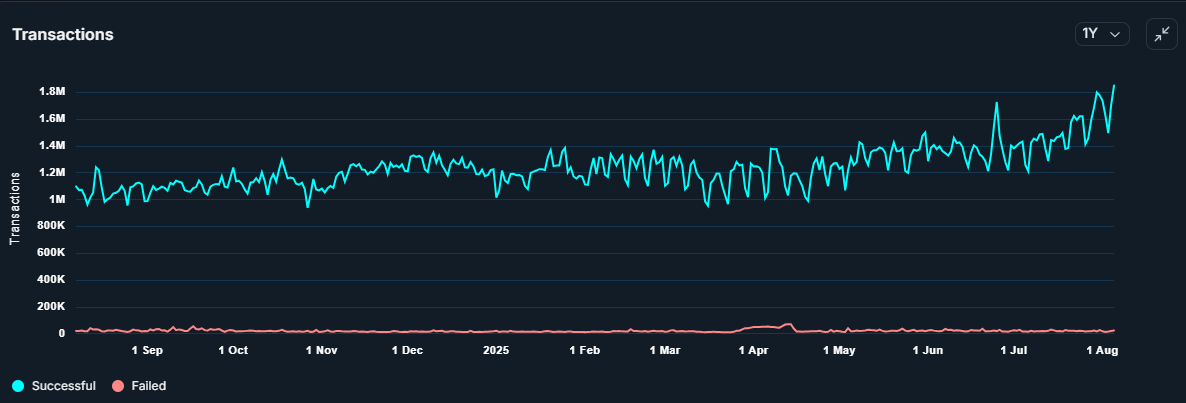

Transactions on the Ethereum network have reached a one-year high as the US Securities and Exchange Commission issues new guidance on staking.

This comes amid historical highs in Ether staked on the network; according to Dune Analytics, over 36 million Ether

ETH$4,198is nowstakedon Ethereum, representing nearly 30% of the total token supply.

A large number of tokens locked into smart contracts indicates that Ether holders are hunkering down, preferring to render their ETH unsellable for the time being in exchange for staking rewards.

The increased network activity follows guidance from the SEC and an additional commission statement that liquid staking may be exempt from securities laws; however, commentary from one commissioner suggests that it may not be that simple.

Liquid staking on Ethereum in “muddy waters”

On Tuesday, the SEC’s Division of Corporation Finance released a “Statement on Certain Liquid Staking Activities.” In it, the division defined and explained its views on liquid staking.

Liquid staking is a form of staking that issues a token representing a user’s staked asset. It allows investors to continue using decentralized finance (DeFi) protocols while earning staking rewards.

The division said that liquid staking activities, as well as the offer and sale of “staking receipt tokens,” insofar as they are described in the SEC’s statement, do not “involve the offer and sale of securities” as defined by the 1933 Securities Act.

As such, entities issuing “staking receipt tokens,” so long as those tokens don’t constitute some form of investment contract, do not need to be registered with the SEC.

The DeFi industry was quick to hail the updated guidance as a victory.

“Institutions can now confidently integrate LSTs [liquid staking tokens] into their products, which is sure to drive new revenue streams, expand customer bases and enable the creation of secondary markets for staked assets,” Mara Schmiedt, CEO of blockchain developer company Alluvial, previously told Cointelegraph.